The Standard-Setting Process

The PCAOB seeks to establish and maintain high quality auditing and related professional practice standards for audits of public companies and other issuers, and broker-dealers in support of the PCAOB mission to protect investors and further the public interest in the preparation of informative, accurate, and independent audit reports. The PCAOB Office of the Chief Auditor — working with other PCAOB offices and divisions — assists the Board in establishing and maintaining PCAOB standards.

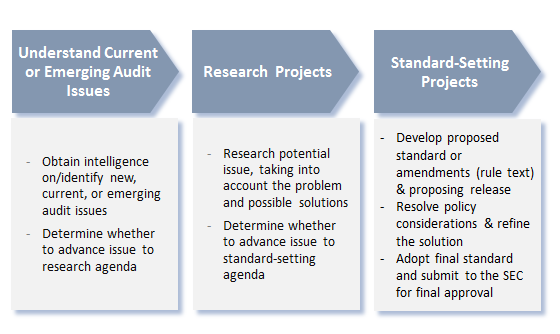

The PCAOB standard-setting activities include identifying current or emerging audit issues, developing the research agenda, and working on standard-setting projects. These are informed by a range of activities, such as the PCAOB's oversight, monitoring and outreach activities, discussion with SEC staff, the work of other standard setters (for example, the International Auditing and Assurance Standards Board), and other relevant inputs and developments.

The PCAOB takes a priority-based approach to standard-related projects. The timing of each phase may vary from project to project, depending on the nature and scope of audit issues involved. A high level overview of the standard-setting process follows.

Understand Current or Emerging Audit Issues. The process begins with an environmental scan to identify current or emerging audit issues to inform the Board about matters that potentially warrant changes to PCAOB standards or that warrant additional staff guidance. The staff continue to monitor current or emerging issues, including observations from oversight activities, that may merit further consideration. The evaluation of potential issues may result in a project being added to the research agenda.

Research Projects. For each research project, an interdivisional research team is formed to perform research, outreach, and economic analysis to assess whether there is a need for changes to PCAOB standards; consider alternative regulatory responses; and, if standard setting is needed, evaluate the potential standard-setting scope and approaches. If standard setting is pursued, the project would be added to the standard-setting agenda. If standard setting is not pursued, consideration would be given to whether any other action is needed. For example, the staff may prepare guidance regarding the application of existing PCAOB standards.

In addition to the projects on the research agenda, the staff also conducts monitoring activities in other areas that could impact audits or PCAOB standards (e.g., financial reporting fraud, auditor independence, and new accounting standards).

Standard-Setting Projects. For each standard-setting project, the PCAOB solicits public comment on potential changes to standards before adopting changes. Consideration of changes to standards also involves conducting an economic analysis and analyzing the potential impact of changes on audits of emerging growth companies. Staff Guidance on Economic Analysis in PCAOB Standard Setting (Feb. 14, 2014), was prepared to provide guidance to staff involved in rulemaking.

After the Board adopts changes to its standards, the changes must be approved by the SEC to become effective.

Further information about the PCAOB's projects may be found at Research and Standard-Setting Projects. The descriptions of these projects posted on our website are prepared by the staff of the Office of the Chief Auditor, and are not statements of the PCAOB, nor do they necessarily reflect the views of the Board, individual Board members, or other staff.