Shaping the Future - Talent and Artificial Intelligence

Remarks as prepared for delivery

Good afternoon and thank you for the opportunity to share my views. Before I begin, I want to make clear that the views I express here are my own and do not necessarily represent the views of the PCAOB Board, other Board Members, or PCAOB staff. I have been speaking about technology and talent since 2021 which was my first year on the PCAOB Board.1 These two topics have only gotten more attention over the past three years throughout our profession, and I am delighted to be here today to talk about some recent developments as well as my reflections on these two topics.

Talent

Many stakeholders have been discussing the talent pipeline crisis and solutions for some time. The AICPA established the National Pipeline Advisory Group (NPAG), which comprises representatives from accounting firms, State Boards of Accountancy, State CPA Societies, academia, and business, in July 2023, to help shape a national strategy to address talent shortages. A year later, NPAG released a report with “data-driven strategies to boost accounting pipeline.”2 I read the report last week and found its analysis comprehensive and informative. I also found the recommendations to be actionable and holistic. The overarching conclusion I drew from the report is that there is not one magic bullet; instead, the entire accounting profession must work together to solve the problem.

Today, I would like to focus on one of the recommendation themes: tell a more compelling story about accounting careers. A little over a month ago, the Journal of Accountancy published a paper I wrote titled “How CPAs can bring order to a disorderly world” where I articulated a tech-oriented vision for the future of accounting.3 I am delighted to share that vision personally with you today.

Accounting has been crucial in facilitating commerce for centuries. Its contribution to business is well-documented and widely known. However, people generally do not think of accountants as innovators. I hope that I can bust that myth, because accountants have been innovators and problem-solvers since the beginning of civilization. The concept of accounting arose long before modern civilization during the Mesopotamian era. Mesopotamia was among the earliest human civilizations and known as the “Cradle of Civilization” for the many innovations created in the region, which is part of modern-day Iraq, Kuwait, Turkey, and Syria.4 Mesopotamians have made many discoveries that have changed the world, including math, the concept of time, and writing. This means that accounting is one of the oldest professions of mankind, and the enduring legacy of accounting is well-established.

In 1494, Luca Pacioli, an Italian monk and mathematician, codified the idea of a double-entry accounting system. Pacioli’s famous quote “without order, there is chaos” reveals his belief that accounting brings order to a world of chaos. More than five centuries later, there is no better time for accountants to rise up to the occasion to bring order to our chaotic world. A large part of the chaos is rooted in the growing lack of trust in our country and our world. The Edelman Trust Barometer, a worldwide survey on trust conducted annually since 2001, reported a crisis in trust beginning in 2017, when the general population’s trust in four key institutions — business, government, NGOs, and media — declined broadly to below 50%.5 Since then, trust continues to deteriorate and the U.S. trust index based on the 2024 report6 is 46, a 2-point decline from 2023. A lack of trust destabilizes our ability to solve problems, as people cannot even agree on the nature and extent of the various problems. That’s why an enduring and engaged accounting profession is needed more than ever before.

Accounting requires rigorous technical training. Accountants, however, are not merely technicians. Analytical and problem-solving skills were the foundational skills developed. The double-entry system provides the basis for learning multidimensional and interconnected concepts. Furthermore, one of the most important skills is the ability to communicate, because accountants ultimately need to help others understand complex problems and ideas. One complexity and opportunity that exists today is technology. Accountants who are technology-literate can expand their technological capacity to transform the world. With these broad and versatile skillsets, one would think that the profession should be exceedingly attractive and that students would flock to this field.

The NPAG report did a great job explaining the various reasons why the profession is unable to attract enough talent. Among many reasons, I believe that one of the major barriers is the younger generation’s misperception of the profession. The current perception of the accounting profession among college students is that it is “monotonous,” “unfulfilling,” “not challenging,” and so on.7 Young people with modern perspectives are vitally needed to reinvigorate the profession for a world increasingly shaped by rapid technological advancements, an abundance of data and information, and media saturation. This profession needs a contemporary vision.

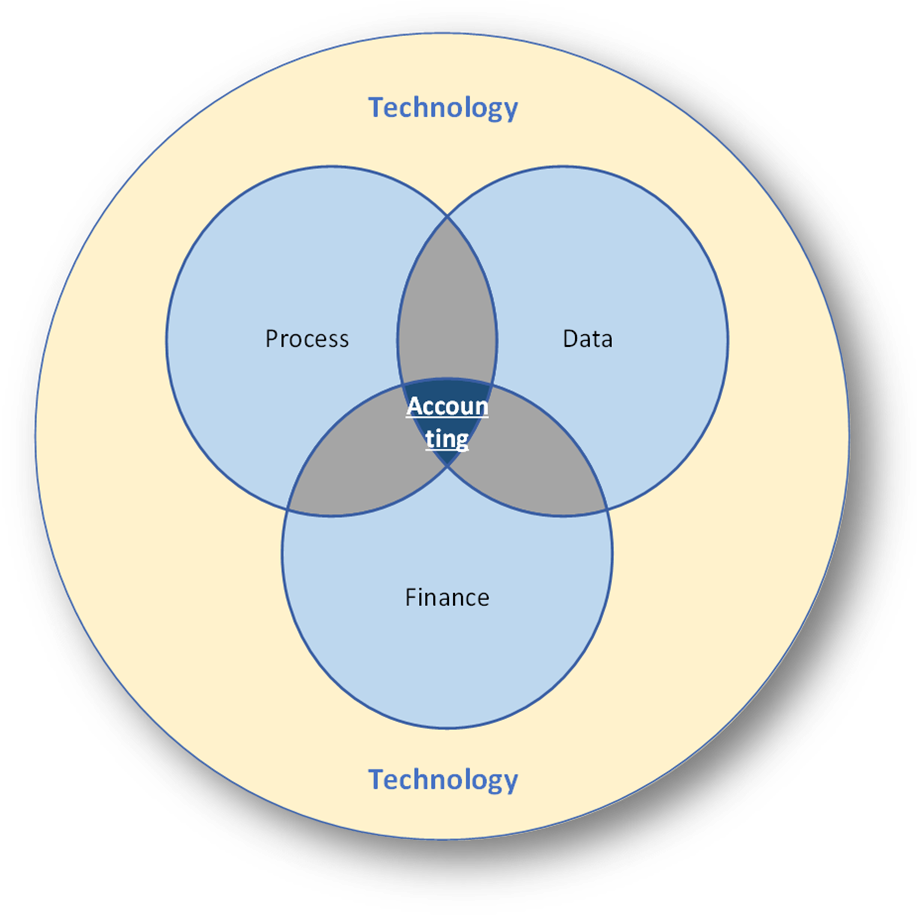

As I mentioned in my paper, in the technologically and data-driven 21st century era, accounting is a discipline that resides at the intersection of three domains: data, process, and finance, which are enabled by technology. To bring order and transparency to a chaotic and complex world requires a multidisciplinary approach by applying expertise in three domains (see illustration on the screen):

- Data: Accountants have been creating, validating, analyzing, and interpreting data since the invention of writing. The “ordering” of data enables the extraction of insights for decision-making and problem-solving.

- Process: Accountants are trained to focus on internal controls and are often experts in understanding the underlying processes that create data and facilitate business transactions. Process facilitates repeatability, consistency, and predictability.

- Finance: All problems and risks need to be consistently broken down and measured in terms of their financial impact. Accountants can translate these risks into comparable and trusted financial measures for strategic decision making.

Finally, technology influences and enables the integration of the three aforementioned domain areas. In other words, technology is imperative for helping accountants bring order to a disorderly world and build trust in the problem-solving process. That leads me to the topic of Artificial Intelligence (AI).

Artificial Intelligence

GenAI has captured the attention of our nation and world since the release of the first ChatGPT in November 2022. Subsequently, the President issued the Executive Order (EO) on the “Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence” at the end of October 2023, and the European Parliament formally adopted the European Union Artificial Intelligence Act in March 2024. If there was any doubt or debate about how significant AI technology is and will be to the global economy, welfare, and liberty, these two significant actions put that debate to rest. The American public has already adopted AI technology in many aspects of their lives. For example, I wear a device that tells me everything about my health including my sleep performance, fitness, and stress level. Never have I felt so informed and empowered to take control of my own health. In addition, most people I know have had some kind of voice generated AI at home for years.

In my opinion, AI provides a significant opportunity to reimagine accounting and auditing. Accountants can use AI to process and analyze data at unprecedented velocities. New technologies, such as process mining, can help accountants analyze and validate processes efficiently and automatedly. AI can also be used to automate processes, predict risks, and detect fraud. Big public accounting firms and issuers are making significant investments in AI and other technologies to improve audit quality and financial reporting. PCAOB published a spotlight8 in July this year to share observations on the use of GenAI in audits and financial reporting based on our outreach to some firms and preparers. The spotlight notes the use of GenAI tools by both auditors and preparers in less complex and repetitive processes. Although these firms and issuers are investing in AI, they continue to emphasize the need for human supervision and review of the GenAI outputs. They also note challenges and risks related to data security, output reliability and consistency, as well as governance.

Since I am constantly thinking about what the PCAOB can do to facilitate innovation in the public company auditing space with the end goal being to improve audit quality and to promote a healthy capital market system, I frequently ponder what can and should the PCAOB change in our rules and programs to encourage the responsible use of AI to improve audit quality? For example, should the PCAOB issue guidance on AI use, principles, and a risk management framework, perhaps building off of the guidance the federal government has been developing as part of the AI EO. Given the generative nature of GenAI, I also wonder if we should stand up research infrastructure that would (1) promote learning and innovation within the public company auditing ecosystem; and (2) help identify risk mitigation strategies around the auditability of GenAI. Our historical approach of rulemaking may not be as effective for issuing standards related to AI, because AI is evolving so fast. So, how can we be more agile in our learning and our standard setting?

Shaping the Future

I have written that the accounting profession is at a pivotal moment, given the precarious trust environment, rapid technology advancement, and talent shortages. We can either maintain the status quo and risk becoming irrelevant, or we can be bold and lead the way in solving complex problems by using the most important skill all accountants are trained to have — understanding the data to discern the truth.

To realize this bold vision, we need every accounting practitioner to drive changes in this profession. Specifically, collaborative and consistent effort is required in five main sectors:

- Corporate (audit committee chairs/members and directors/CFOs/controllers/internal auditors): Focus on (1) driving data standards within each company and across the industry when feasible; (2) driving innovation to automate routine tasks and increase productivity; and (3) engaging stakeholders publicly when breaking down problems and making data-driven decisions to the extent possible.

- Public accounting (firm leadership): Adopt data-centric audit approaches and use technology to improve audit quality; train staff to be thinkers and problem-solvers in addition to being task executors.

- Academia (accounting faculty members): Develop accounting students' data analytic skills and technology aptitude. Publish more research on the accounting profession's contribution of novel ideas for using data and technology to improve financial reporting and auditing.

- Government (financial executives): Commit to a data-centric and user-centered approach when developing and operating new financial management programs. Implement data-driven initiatives to improve efficiency and effectiveness of government programs.

- Regulators/standard setters: Proactively develop feasible, agile, and cost-effective policies and standards that help enable the responsible use of rapidly evolving technology within the accounting and auditing professions.

It will take time to turn this vision into reality, but collectively this profession has the ingenuity, influence, and intellect to make it materialize. I look forward to the day when accountants are innately regarded as decoders of complex problems, arbiters of facts, cultivators of order and solutions, and, ultimately, trust builders.

Thank you.

1 Technology and Talent - Audit Quality Challenges in the 21st century. (2021). https://pcaobus.org/news-events/speeches/speech-detail/ho-technology-and-talent-audit-quality-challenges-in-the-21st-century

2 National Pipeline Advisory Group (2024, August 1). NPAG releases data-driven strategies to boost accounting pipeline - National Pipeline Advisory Group. National Pipeline Advisory Group - The National Pipeline Advisory Group is a profession-wide effort to tackle the talent shortage and attract more people to a rewarding career in accounting. https://www.accountingpipeline.org/npag-report/

3 Ho, C. C., CPA. (2024, August 29). How CPAs can bring order to a disorderly world. Journal of Accountancy. https://www.journalofaccountancy.com/news/2024/aug/how-cpas-can-bring-order-to-a-disorderly-world.html

4 Mesopotamia - Map, Gods & Meaning | HISTORY. (2017, November 30). HISTORY. https://www.history.com/topics/ancient-middle-east/mesopotamia

5 2017 Edelman TRUST BAROMETER. (2017, January 21). Edelman. https://www.edelman.com/trust/2017-trust-barometer

6 Global Report (pp. 2–9). (2024). https://www.edelman.com/sites/g/files/aatuss191/files/2024-02/2024%20Edelman%20Trust%20Barometer%20Global%20Report_FINAL.pdf at 6

7 Brink, W., CPA, PhD; Eaton, T., PhD; Heitger, D., PhD. (2023, June 1). How students view the accounting profession. Journal of Accountancy. https://www.journalofaccountancy.com/issues/2023/jun/how-students-view-the-accounting-profession.html

8 Staff update on outreach activities related to the integration of generative artificial intelligence in audits and financial reporting. (2024). [Report]. https://pcaobus.org/documents/generative-ai-spotlight.pdf